Multiple industries have been adopting data-driven intelligence for making business decisions in the last few years. However, the uptake has been relatively slow for the commercial real estate segment. Operators and decision-makers are usually more interested in the revenue part of the business than in the back-end process efficiencies. The tools primarily used are spreadsheets, calculators, and manual instincts to make decisions.

Although the operators make money from their real estate investment, understanding the actual ROI becomes difficult with this approach. Subsequently, the lack of process and operation streamlining results in multiple leaks and obscures the realization of the potential valuation of the property. Despite generating healthy revenue, the operators are often affected by the revenue loss that comes from a lack of accuracy and operational effectiveness.

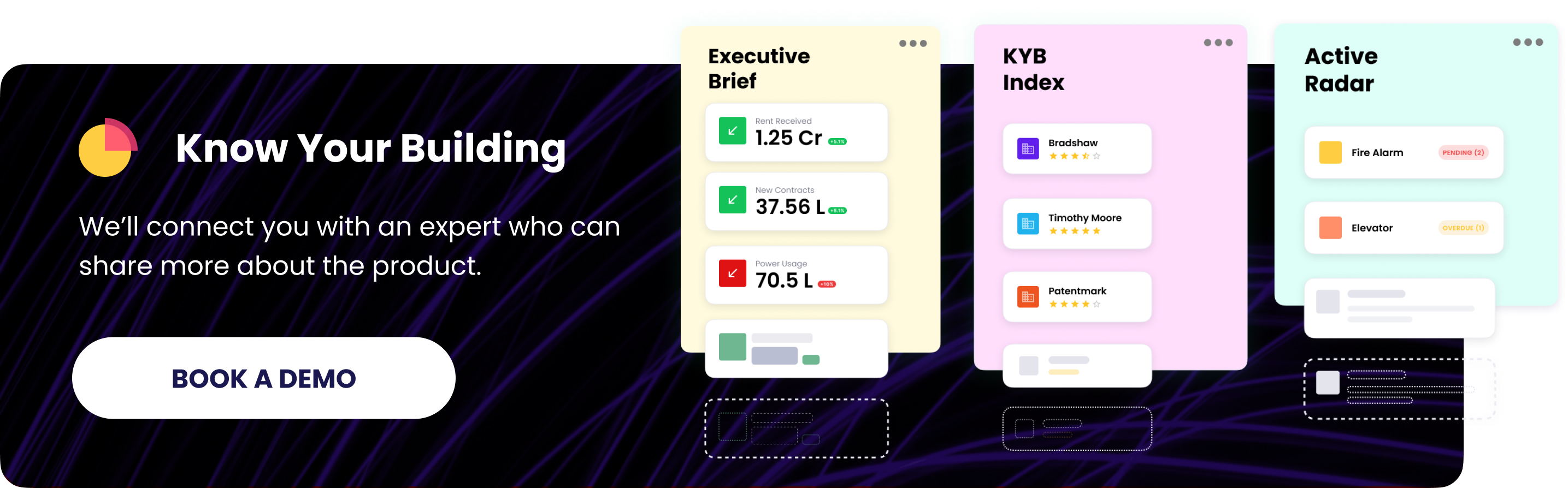

One of the most convenient methods of appreciating the income and spending ratio is utilizing an automated insights dashboard. It can benefit the operators to comprehend the expense head and validate the revenue generated in real-time to improve their ROI. It can also monitor various aspects of the property and allow the stakeholders to make data-driven decisions.

This article explains the fundamentals of having an automated insight board and its impact on the process and business ROI. Let’s find out the details.

How does an automated insights dashboard impact ROI

The commercial real estate segment traditionally operates within the realm of NOI or Net Operating Income rather than ROI or Return on Investment. The NOI allows the operators to calculate the money an asset generates after deducing the expenses. On the other hand, ROI helps them understand the time and effort required to create a positive return.

Although both look similar in the context of the CRE industry, NOI is a straightforward calculation. However, ROI helps operators understand their earning and expense patterns, identify opportunities to grow the revenue, and improve property valuation.

An automated dashboard helps every stakeholder associated within the CRE sector to increase their revenue. Automated insights allow them to monitor energy consumption and reduce wastage. Subsequently, investing in automation is justified with the recurring savings on other expenditures. The automation facility can be shown as a premium feature to the tenants and allows the stakeholders to increase property costs.

Implementing an automated insights dashboard to increase ROI

The introduction of automated insights and consolidated dashboards can improve organizational efficiencies in commercial buildings. It automates the work activities that require frequent monitoring or redundant checks by manual methods. Consequently, the data is generated in real-time, and operational activities can be better managed.

One of the aspects that automated dashboards can improve drastically is asset management. Based on real-time feedback, stakeholders can visualize the tenant data, understand the occupancy rates, and maximize asset usage. They can further check the energy consumption levels, maintenance schedule, lease expiry date, etc. All these data can be accessed through a consolidated dashboard, therefore eliminating the need for multiple spreadsheets. Further, income and expenditure status can be easily monitored without involving multiple accounts or floor managers. Finally, the collected data can create trends and patterns that facilitate forecasting revenue generation and help the operators make informed decisions regarding their investments.

The dashboard further helps the building managers visualize any maintenance issues that might come up. The breakdowns are tracked on a real-time basis and are even taken care of by the dashboard. As a result, it helps managers de-escalate delays due to minor maintenance issues and adds to the overall convenience. Since the resolution works faster than manual intervention, the expenditure is reduced as operators can better manage their maintenance staffing.